The 1031 exchange rules in California are mostly the same as they are throughout the rest of the country. That’s because it’s a federal IRS policy that the 1031 exchange is based on: IRS Code Section 1031. There are, however, a few points specific to doing a 1031 exchange in California that are very important to know for real estate investors.. In this guide, we’ll explain how a 1031

Real Estate 1031 Exchanges in Monterey County • Monterey Peninsula Real Estate

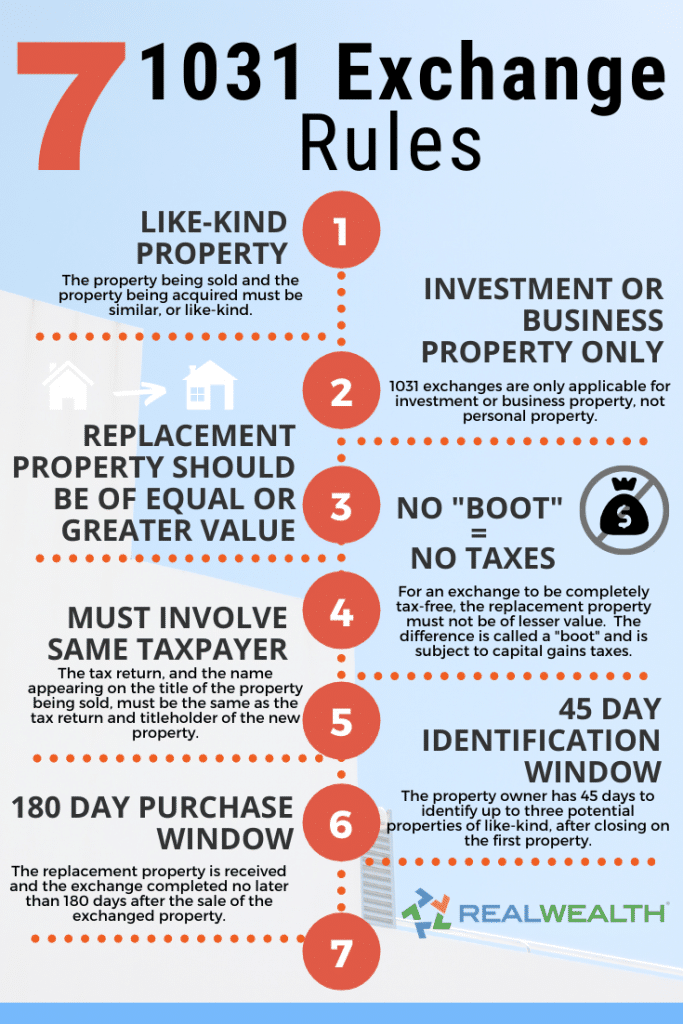

A 1031 exchange is a tax-deferred exchange that allows you to defer capital gains taxes as long as you are purchasing another “like-kind” property. This exchange mechanism is used by some of the most successful real estate investors and can be beneficial in a variety of situations. The following is a general guide to a 1031 exchange in

Source Image: realwealth.com

Download Image

Jul 13, 2023Here’s the general overview of what the 1031 exchange costs can be (on average): Total exchange fees: $600-$1,200. QI fees: $750-$1,250. QI fee per extra property in the exchange: $300-$400. Appraisal for purchase contract: Around $5,000. Inspection fee: $0.1/sqft.

Source Image: aagla.org

Download Image

1031 Exchange Timeline | CPEC – 1031 Exchanges in Minneapolis, MN The 1031 exchange rules in California require that the exchange be completed within certain deadlines. Firstly, investors must identify their replacement property within 45 days of selling their relinquished property. If two or more properties are being identified as replacement properties, these must be identified within the same 45-day period.

Source Image: ghjadvisors.com

Download Image

1031 Exchange From California To Another State

The 1031 exchange rules in California require that the exchange be completed within certain deadlines. Firstly, investors must identify their replacement property within 45 days of selling their relinquished property. If two or more properties are being identified as replacement properties, these must be identified within the same 45-day period. Jul 14, 2023A California resident uses a 1031 exchange to sell property in California and replace it with property in Arizona. This tactic allows the investor to defer both federal and state capital gains taxes. Later, the California resident sells the Arizona property, not using a 1031 exchange. Now the taxpayer will owe federal income taxes.

1031 Like-Kind Exchange California Storm Disaster Relief Deadline Extensions – GHJ

May 24, 2023A 1031 exchange allows him to use the funds from the sale to pay for the new property. This process pushes back his tax liability and exempts him from paying the IRS and state taxes on the gain of the current sale, or $750,000 in capital gains taxes. $3M. $3.5M. What is 1031 Exchange? Know The Rules – JavaTpoint

Source Image: javatpoint.com

Download Image

Our Exclusive 1031 Exchanges, DSTs and Real Estate Planning Seminar, Keller Williams OC Coastal Realty, San Clemente, January 16 2024 | AllEvents.in May 24, 2023A 1031 exchange allows him to use the funds from the sale to pay for the new property. This process pushes back his tax liability and exempts him from paying the IRS and state taxes on the gain of the current sale, or $750,000 in capital gains taxes. $3M. $3.5M.

Source Image: allevents.in

Download Image

Real Estate 1031 Exchanges in Monterey County • Monterey Peninsula Real Estate The 1031 exchange rules in California are mostly the same as they are throughout the rest of the country. That’s because it’s a federal IRS policy that the 1031 exchange is based on: IRS Code Section 1031. There are, however, a few points specific to doing a 1031 exchange in California that are very important to know for real estate investors.. In this guide, we’ll explain how a 1031

Source Image: randallrealty.com

Download Image

1031 Exchange Timeline | CPEC – 1031 Exchanges in Minneapolis, MN Jul 13, 2023Here’s the general overview of what the 1031 exchange costs can be (on average): Total exchange fees: $600-$1,200. QI fees: $750-$1,250. QI fee per extra property in the exchange: $300-$400. Appraisal for purchase contract: Around $5,000. Inspection fee: $0.1/sqft.

Source Image: cpec1031.com

Download Image

Guide to 1031 Exchanges | Understanding 1031 Exchanges Aug 9, 2022A 1031 Exchange – sometimes called a Deferred Exchange or Like Kind Exchange – is a type of commercial real estate transaction that allows investors to defer capital gains taxes on the profitable sale of an investment property as long as they reinvest the sales proceeds into another “like kind property.”. To receive full tax deferral

Source Image: 1031crowdfunding.com

Download Image

1031 Exchange Requirements – Does Your State Qualify? – YouTube The 1031 exchange rules in California require that the exchange be completed within certain deadlines. Firstly, investors must identify their replacement property within 45 days of selling their relinquished property. If two or more properties are being identified as replacement properties, these must be identified within the same 45-day period.

Source Image: youtube.com

Download Image

1031 Exchange Out Of State – This Week in Multifamily – YouTube Jul 14, 2023A California resident uses a 1031 exchange to sell property in California and replace it with property in Arizona. This tactic allows the investor to defer both federal and state capital gains taxes. Later, the California resident sells the Arizona property, not using a 1031 exchange. Now the taxpayer will owe federal income taxes.

Source Image: youtube.com

Download Image

Our Exclusive 1031 Exchanges, DSTs and Real Estate Planning Seminar, Keller Williams OC Coastal Realty, San Clemente, January 16 2024 | AllEvents.in

1031 Exchange Out Of State – This Week in Multifamily – YouTube A 1031 exchange is a tax-deferred exchange that allows you to defer capital gains taxes as long as you are purchasing another “like-kind” property. This exchange mechanism is used by some of the most successful real estate investors and can be beneficial in a variety of situations. The following is a general guide to a 1031 exchange in

1031 Exchange Timeline | CPEC – 1031 Exchanges in Minneapolis, MN 1031 Exchange Requirements – Does Your State Qualify? – YouTube Aug 9, 2022A 1031 Exchange – sometimes called a Deferred Exchange or Like Kind Exchange – is a type of commercial real estate transaction that allows investors to defer capital gains taxes on the profitable sale of an investment property as long as they reinvest the sales proceeds into another “like kind property.”. To receive full tax deferral